The Epstein Whistleblower Who Was Silenced

A former Deutsche Bank compliance officer told the FBI she was fired in 2018 after flagging suspicious activity in accounts linked to Jeffrey Epstein and Jared Kushner, offering yet another example of how they operated above the law.

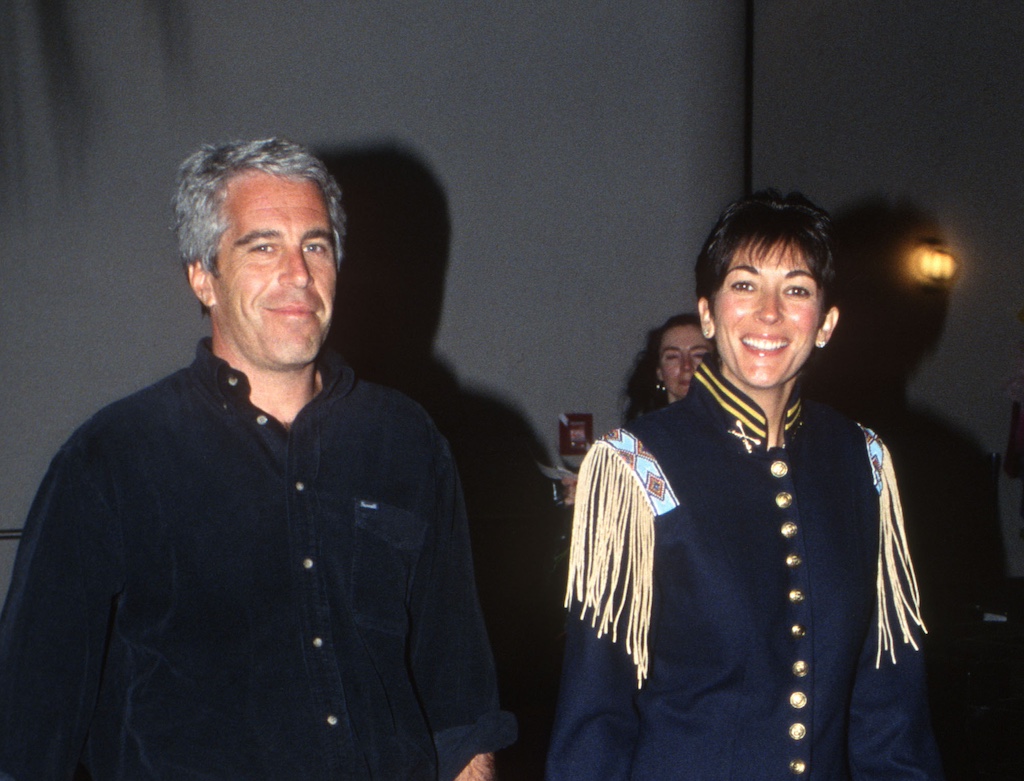

A newly released FBI interview sheds new light on Tammy Hill McFadden’s allegations in regards to accounts tied to Jeffrey Epstein and Jared Kushner. (Patrick McMullan / Getty Images)

A former compliance officer for the international financial powerhouse Deutsche Bank told the Federal Bureau of Investigation (FBI) she was fired in 2018 after raising concerns about suspicious banking activity from accounts owned by financier and sex predator Jeffrey Epstein, as well as accounts linked to Jared Kushner, President Donald Trump’s son-in-law, adviser, and business partner. The allegations come from an FBI interview report included in the Justice Department’s latest release of Epstein-related documents.

The former anti-money laundering official detailed “mind-boggling” cryptocurrency transactions between Kushner’s company and a Russian individual. She also claimed that she was punished after raising concerns about more than a hundred politically connected individuals who had been shielded from typical anti-money laundering reviews.

Deutsche Bank has already faced intense scrutiny and paid hundreds of millions for the years it spent doing business with Epstein. Starting in 2013, the bank allowed Epstein to open up to forty accounts despite his 2008 conviction for soliciting a minor.

But the new FBI records shed light on internal divisions within the financial institution over how to handle what would become one of Deutsche Bank’s most notorious clients — and the alleged blowback against those who questioned the scandal-plagued lender’s decision to prioritize Epstein’s patronage over potential ethical and legal concerns.

Tammy Hill McFadden, according to a July 12, 2019, FBI report, worked as a Florida-based anti-money laundering compliance officer for Deutsche Bank until 2018, when she was terminated in what she claims was an act of retaliation. McFadden previously worked as a manager in Deutsche’s client compliance offices until 2014, when such work was “outsourced to India.”

According to the FBI interview, McFadden raised concerns to her supervisor in 2015, about transactions involving Epstein, telling investigators that “it appeared that Epstein sent wires to young women, perhaps in their twenties” in addition to a woman who owned an art gallery in France.

McFadden also informed her supervisor that she “no longer wanted to work on Epstein’s accounts.” But she said she was told that “Epstein served his time,” referring to the sex offender’s 2008 plea agreement with the state of Florida, which allowed Epstein to serve thirteen months in prison with a twelve-hour-a-day work release.

The Lever could not reach McFadden for comment. But she apparently wasn’t alone in her reservations about the financier.

“The entire Jacksonville, FL [Deutsche Bank anti-money laundering] team wanted to terminate the relationship with Epstein,” McFadden told investigators. Despite this, Deutsche Bank was slow to act, failing to close all of Epstein’s accounts until after his 2019 arrest for sex trafficking.

McFadden’s claims align with those made by New York State financial regulators in 2020 as part of a $150 million fine they levied against the bank for allegedly profiting from Epstein’s crimes by failing to maintain an effective and compliant anti-money laundering program.

The claims also line up with a 2022 suit filed against Deutsche Bank by Epstein’s victims, who were eventually awarded $75 million. Plaintiffs accused Deutsche executives of “choosing profit over following the law” by knowingly allowing and financing illegal financial activity related to Epstein.

In the FBI report, McFadden also makes previously unpublicized revelations about an incident that she claims sparked a retaliation campaign against her. In late 2015, McFadden alleged she found 102 “politically exposed persons” who were “high risk individuals” that “should have been addressed immediately,” but whose designation in the bank’s internal anti-money laundering system had been deferred indefinitely.

Politically exposed persons, or “PEPs,” are individuals connected to public office or government who are flagged for closer inspection in banks’ anti-money laundering compliance efforts because they may present a higher risk of illicit financial activity.

“Deferred status was basically like ‘cyber space,’” according to McFadden in the FBI report. “In order for something to be in deferred status, someone would have needed to change the status accordingly.”

By flagging the deferred status of the 102 politically exposed persons in what she assumed was an oversight, McFadden says she triggered a retaliation campaign by her supervisor, who immediately “began rejecting all of [her] work.” According to McFadden, the rejections sank her productivity reports, ruined her bonus, and eventually led to her 2018 termination, despite no prior performance issues before 2015.

Deutsche Bank declined the Lever’s request for comment.

“Easy to Determine the Activity Was Suspicious”

The year following her termination, McFadden went public in the New York Times, alleging she was fired after trying to flag suspicious activity from powerful individuals, including Kushner and Trump.

In response, Deutsche Bank told the New York Times, “At no time was an investigator prevented from escalating activity identified as potentially suspicious. Furthermore, the suggestion that anyone was reassigned or fired in an effort to quash concerns relating to any client is categorically false.”

The New York Times report made no mention of Epstein; he would be arrested for sex trafficking several months later, on July 6, 2019. McFadden was interviewed by the FBI six days afterward.

The newly released FBI interview sheds new light on McFadden’s allegations against Kushner. According to McFadden, in 2016, she came across a business account owned by Kushner, for which it was “easy to determine the activity was suspicious, and there was an issue.”

“The majority of the transactions were in cryptocurrency and [McFadden] was unable to validate the origination or the recipient of the funds,” the report states. “[Kushner’s business] appeared to be paying an employee in cryptocurrency.”

The FBI report states that McFadden found Kushner’s business activity to be “mind boggling” and that “she had never seen a flow like that.”

One payment appeared to involve a Russian individual whose name McFadden searched for online. She allegedly found a “bogus” website “that appeared to be made up,” listing the individual as an employee of Kushner’s. When McFadden visited the Kushner business’s website, “the individual was not listed as an employee.”

McFadden says her supervisor determined the claims about Kushner were “unfounded,” and that when she insisted, McFadden was directed to a woman referred to only as “Rose.” Rose was reportedly Kushner’s “relationship manager” at Deutsche Bank, responsible for maintaining the bank’s ties to high-net-worth clients.

According to McFadden, relationship managers “were not supposed to contact the client or ask them questions related to the activity,” as it is their “duty to monitor the due diligence of their client’s [sic].” However, McFadden alleges that the case in question was closed after Rose contacted Kushner’s business.

Kushner Companies, LLC, a real estate company owned by the Kushner family, did not respond to a request for comment.

Responding to McFadden’s 2019 allegations, a spokesperson for the Kushner Companies told the New York Times that “any allegations regarding Deutsche Bank’s relationship with Kushner Companies which involved money laundering is completely made up and totally false.”

McFadden didn’t know whether Trump or Kushner were on the list of 102 politically exposed people shielded from “high-risk” status in the bank’s anti-money laundering system. However, according to court documents, Deutsche Bank designated Epstein an “honorary” politically exposed person, suggesting he, too, was protected from increased scrutiny.

“I suspect they use this term to fudge things,” noted a confidential witness in the Epstein victims’ suit against Deutsche Bank. “Epstein was certainly very high risk. . . . But Deutsche Bank did not treat him as a high-risk client. I think the phrase ‘honorary PEP’ has been dreamt up to explain away why he wasn’t treated as a high-risk client — whose accounts should have been constantly reviewed.”