Capitalism Enabled Jeffrey Epstein’s Crimes

The strategies Jeffrey Epstein used to hide the money funding his sex trafficking organization were perfectly legal. In fact, they are the same legal strategies that most of the top 0.1% uses to avoid taxes and other regulations.

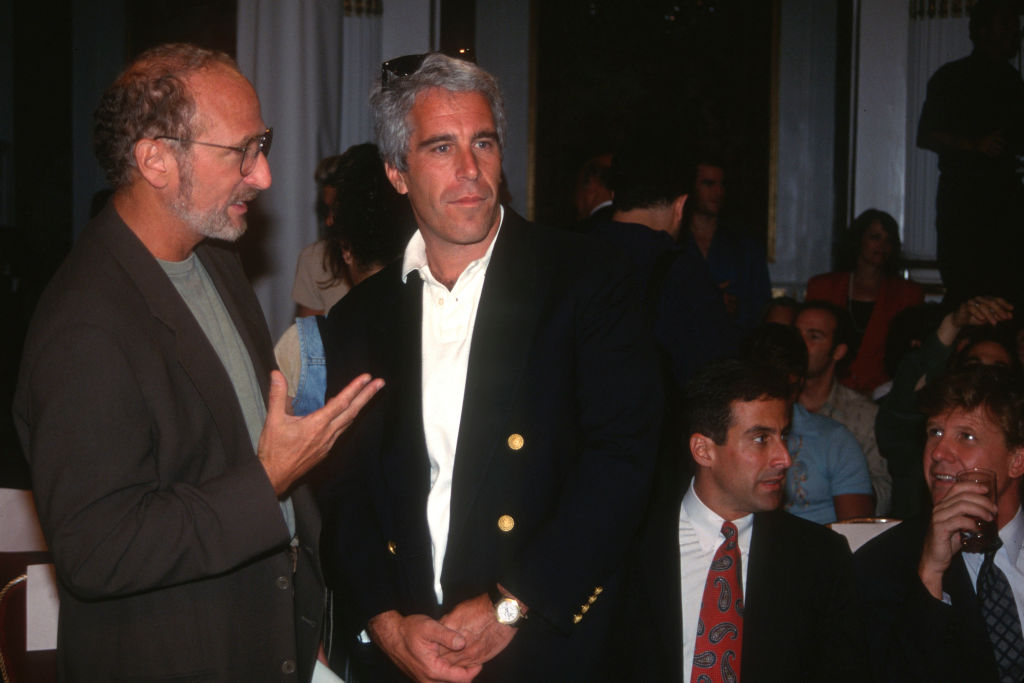

While Jeffrey Epstein likely used blackmail and other illegal schemes to avoid prosecution for his crimes, his primary strategy — offshore wealth management — was not just legal but a central feature of modern financial capitalism. (Patrick McMullan via Getty Images)

Jeffrey Epstein is in the news again, this time after the House Oversight Committee released a whole library of his correspondence over the years. On one hand, the rare glimpse into the world of elite power brokerage this offers is fascinating. Like most rich people, Epstein and his conspirators clearly believed that they were above the law and often talked about their blackmail schemes in perfectly blunt terms. For example, in a letter to Epstein, journalist Michael Wolff says of Donald Trump, “If he says he hasn’t been on the plane or to the house . . . you could save him, generating a debt.”

Writing for the American Prospect, David Dayen has argued that Epstein is, at heart, a story of elite impunity for their crimes. He lays out the evidence about the human trafficking ring he ran and the endless number of rich people who were implicated in it; he then summarizes this as “a set of crimes perpetrated by a wealthy guy [that] reached into the heights of the political and economic stratosphere, and went largely unpunished for decades.”

The criminal dimension of the Epstein case is important, but I think Dayen’s focus on it misses something crucial: that much of what Epstein did was completely legal.

Epstein’s human trafficking organization depended entirely on the wealth management industry (WMI). It was how he obtained the capital to build it, and it was how he hid his activities from the authorities. And none of this was an abuse of the industry; it is precisely how the WMI is designed to work. Nor is it an abuse of the law, because both American and international law has been carefully designed to accomodate the WMI.

Dayen mentions in passing that “the source of Epstein’s wealth” comes from obtaining power of attorney over the estate of Les Wexner, “from which he appropriated bunches of money” — but this is easy to misread as a euphemism for theft. In fact, Epstein was Wexner’s personal money manager, and his “appropriation” of Wexner’s funds is perfectly ordinary in the WMI — even expected.

“We are the staff that runs the machine that funnels resources from the 90 percent to the 0.1 percent,” wealth manager Matthew Stuart tells author Chuck Collins in Wealth Hoarders. “We’ve been happy to take our cut of the spoils.”

Because capitalists rely on extraordinary complex legal and financial strategies to hide their wealth, they have become increasingly dependent upon the expertise — and discretion — of wealth managers. Brooke Harrington, in Offshore, explains:

Many of the ultra-wealthy harbor politically sensitive, potentially explosive secrets of a financial, legal, and personal nature. As one Swiss wealth manager I interviewed put it, clients must metaphorically “undress in front of you,” because all their most private information affects their fortunes and the legal-financial strategies needed to protect them.

There is some reason to believe that Epstein may have leveraged some of those personal secrets to gain access to Wexner’s wealth, but there’s also reason to believe that the truth is far more mundane. Wexner’s previous wealth manager, Harold Levin, has speculated that Epstein took control of properties that Wexner had purchased with company stocks; since banks no longer owned them, there was no paper trail showing what Epstein did with them. Another source close to Wexner, Jerry Merritt, has an even simpler explanation:

Merritt recalled once asking Wexner why Epstein was so well compensated. “Les just said, ‘Because I got more money than I can ever spend,’ ” said Merritt. “Les gave him free rein over his checkbook.”

This, again, is a common story in the WMI: wealthy individuals and families leave the management of capital to a handful of well-positioned lawyers and accountants who are able to exploit their position to command extravagent salaries.

But capitalism didn’t just provide seed funds for Epstein’s operation. It also provided a whole legal and financial apparatus that helped him find victims and disguise his transactions. An article in Deviant Behavior by sociologist Thomas Volscho observes that at first, “the predominant means for gaining access to potential victims involved Epstein using philanthropy to gain access to youth-serving institutions.”

In particular, Epstein seems to have leveraged immense wealth to buy influence in youth organizations that focused on financially at-risk children and then used the wealth disparity to control them. This was a natural step for Epstein, since wealth managers often work with charitable organizations for tax-avoidance purposes. As his conspiracy matured, Volscho writes, Epstein’s “sex trafficking enterprise was funded by Epstein’s tax shelter advisory business, where he primarily helped wealthy people avoid taxation on the sale and/or bequeathing of their assets and incomes.”

Epstein also used his expertise to build the conspiracy’s legal shield — what one federal lawsuit described as a

complex financial infrastructure, which involved dozens of bank accounts at various banking institutions, many of which were held in the name of corporate entities with no legitimate business purpose that appear to have been created to simply facilitate the illegal sex-trafficking venture.

The venture itself was illegal, of course. But the infrastructure Epstein used to hide it — the elaborate networks of shell corporations and mysterious beneficiaries, typically located in offshore jurisdictions with lax financial reporting laws — were themselves perfectly legal. And they are, moreover, the same legal mechanisms that most of the top 0.1 percent uses to avoid taxes and other legal regulations.

To appreciate how normalized these strategies are among capital, all you have to do is read some of Epstein’s correspondence with the rich. In 2013, for example, Pritzker family oligarch Thomas contacted Epstein when his cousin, Penny Pritzker, made the news for hiding $80 million of her wealth from the government. “I clearly did something wrong in my last life to have to deal w this bullshit,” Thomas writes. “AND I warned her.”

While this exchange may seem tangential to Epstein’s crimes, subtext is everything. “The Pritzker family didn’t just build hotels,” WMI executive Aaron Berick writes:

They built the blueprint for generational wealth preservation that every billionaire studies today. . . . [Their] secret? A network of offshore trusts established 50 years earlier that would revolutionaize how America’s ultra-wealthy think about preserving family fortunes.

Thomas’s conversation with Epstein, in other words, isn’t just one between acquaintances. It’s a conversation between two experts in the wealth management industry commiserating about how Penny Pritzker didn’t do a good enough job hiding her wealth.

So while Epstein likely used blackmail and other illegal schemes to avoid prosecution for his crimes, his primary strategy — offshore wealth management — was not just legal but a central feature of modern financial capitalism. If the Left wants to use the Epstein case to talk about elite impunity, that conversation has to begin with the strategies the rich use to hide their finances that are completely legal.