Gavin Newsom Is Backing California’s Billionaires

Governor Gavin Newsom is siding with California’s billionaires against a proposed wealth tax to fund health care. Progressives like Ro Khanna are challenging him.

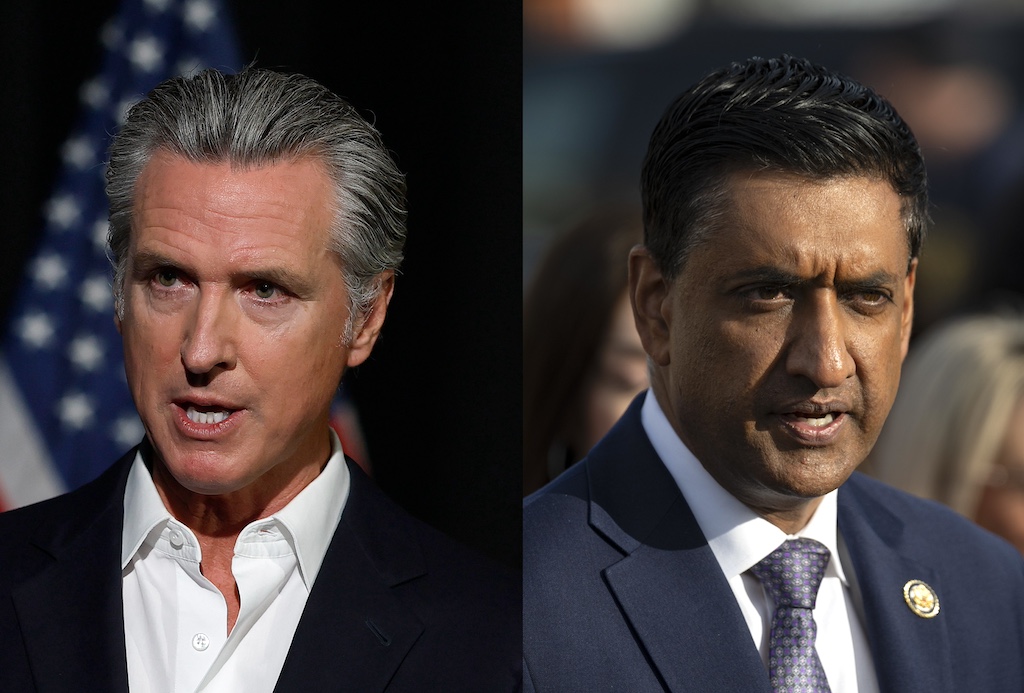

Governor Gavin Newsom is raising money for a committee to defeat the billionaire tax ballot initiative Rep. Ro Khanna is supporting. (Justin Sullivan / Celal Gunes / Anadolu / Getty Images)

At 7:30 a.m. on January 1, 2026, the Washington Post’s editorial board rang in the new year with the headline “California will miss billionaires when they’re gone.” While Americans were still sleeping off their hangovers, the Post — whose owner, billionaire Jeff Bezos, announced a little less than a year ago that the paper’s editorial page would “be writing every day in support and defense of two pillars: personal liberties and free markets — was already chiding unserious progressives and “bloodthirsty unions” for pursuing a state ballot initiative that would levy a one-time wealth tax on California’s billionaires, whom the paper called “the Golden State’s golden goose.”

It doesn’t seem to matter how many studies find that modest tax hikes on the rich do not spur economically devastating out-migration. The argument from economic conservatives is always the same: you better give those benevolent billionaires exactly what they want, which is lower and lower taxes; if you don’t, they’ll leave, and you’ll be sorry. Taxing the rich, or what the Washington Post called “confiscating successful people’s money,” can only lead to financial ruin.

The fight now shaping up around California’s 2026 Billionaire Tax Act is a rerun of last year’s in New York, where then-candidate Zohran Mamdani proposed a new tax on the wealthiest. In California, Silicon Valley–based congressman Ro Khanna is leading the charge, notably breaking with his tech base to champion the initiative. The measure would impose a one-time tax of up to 5 percent on the net worth of California residents with more than $1 billion, raising tens of billions of dollars to shore up the state’s health care system in the face of recent Republican-led cuts.

If it makes it onto the ballot and passes next November, the measure will apply retroactively to anyone who was a California resident on January 1, 2026. The tax would fall on roughly two hundred of the richest Californians, according to the San Francisco Chronicle, but is projected to raise roughly $100 billion. Supporters say this sum is necessary to plug the holes in Medi‑Cal, public hospitals, and other health programs, holes opened by Donald Trump and congressional Republicans. A smaller portion of the revenue will also go to funding public education.

Initiated by the Service Employees International Union-United Healthcare Workers West (SEIU-UHW), the ballot measure has the support of progressives on the national stage. Senator Bernie Sanders called it “a model that should be emulated throughout the country.” But a Democratic opposition is shaping up, too — under the leadership of California’s Democratic governor, Gavin Newsom. Tapping into his tech donor connections, Newsom has begun raising money for a committee to defeat the ballot initiative.

This week, Newsom told the New York Times that the exodus had already begun. He appears to be referencing a Times report from December that California tech billionaires Peter Thiel and Larry Page were opening new branches and limited liability companies in an effort to drop anchor outside of California. On first glance, that does look like tax flight. In truth, however, Thiel’s and Page’s maneuvers were probably nowhere near enough to make a sound legal case for relocation under California’s stringent residency criteria. Instead, they were gestures of protest, which the billionaires hoped would garner press attention and call their allies to arms.

It appears their call was heeded. Khanna, who has been unapologetic in his support of the wealth tax, has borne the brunt of such opposition — especially from the tech industry, which dominates his home district in Silicon Valley. In late December, he called billionaires’ bluff, posting on X, “I echo what FDR said with sarcasm of economic royalists when they threatened to leave, ‘I will miss them very much.’”

In response, Martin Casado, a partner at the tech venture capitalist firm Andreessen Horowitz, accused Khanna of “alienating every moderate I know who has supported him,” which “makes voting him the f— out all the more gratifying.” Garry Tan, CEO of Y Combinator, responded, “Time to primary him,” to which Casado enthusiastically agreed. Andreesen Horowitz and Y Combinator have been major donors to Khanna’s campaigns. Reportedly, Khanna’s wealthy opponents have begun coordinating on WhatsApp to discuss backing an opponent and bankrolling his ouster.

On Sunday, the New York Times reported that Palantir cofounder and Trump-aligned venture capitalist Peter Thiel donated $3 million to a lobbying group to block the ballot measure. The group’s president called Thiel “one of hundreds we have.”

Jesse Powell, the founder of the cryptocurrency exchange Kraken, called the wealth tax idea “the most retarded thing I’ve ever heard,” claiming it would drive billionaires away from California with “all of their spending, hobbies, philanthropy and jobs.” Despite these repetitive claims, however, there remains no compelling evidence that wealth taxes cause high-earner out-migration on a notable scale. Cristobal Young, a Stanford sociologist who conducted a study on high-earner mobility, explained, “The most striking finding in our study is how little elites seem willing to move to exploit tax advantages across state lines. Millionaire tax flight is occurring, but only at the margins of significance.”

To be sure, broader capital flight is a real problem, as seen when companies move their operations from union to nonunion states or countries. But that pattern doesn’t apply to personal income taxes and rich people’s states of residence. The ultrarich have particular reasons why they choose to live in states like New York and California — industry connections, expensive real estate, personal networks, prestige, natural beauty, cultural offerings — which aren’t so easily overridden by modest increases in their tax burdens. New York’s billionaire population has actually grown despite recent wealth taxes, indicating that while some may leave, others tend to take their place.

The utility of the impression that the rich will leave in response to high taxes, however, is inarguable. It may be fiction, but the fiction itself is a valuable political tool that the wealthy use to discourage redistributive policy.

For his part, Khanna doesn’t appear to be buying it. “It’s a matter of values,” he said of the wealth tax. “We believe billionaires can pay a modest wealth tax so working-class Californians have Medicaid.” Khanna went further and called on others in Congress to follow his lead across the country.

The tech billionaires’ stance risks unpopularity, as it clearly pits the personal financial interest of a couple hundred extraordinarily rich people against the urgent health needs of 39.5 million other Californians. Perhaps with this balance in mind, billionaire tech investor Chamath Palihapitiya offered a novel critique of the measure, arguing that billionaires would merely be the canary in the coal mine, with the tax actually opening the door to seizing the assets of ordinary Californians. “Your car, home and jewelry would all count,” he warned non-billionaire Californians.

Both Khanna and Newsom are positioning themselves to run for president as Democrats in 2028, and California’s wealth tax fight offers a snapshot of their political identities. The billionaires are counting on being able to bring Democratic Party politicians to heel with lobbying money and political donations, as they have for the last half-century; Newsom is eager to prove them right. Khanna, meanwhile, is making a more ambitious bet: that coming out of the Trump era, the Democratic Party’s best hope for renewal lies in finally committing to the redistributionary policy that the citizens of this stratospherically unequal society have long needed.