Joe Biden’s Student Debt Plan Didn’t Have to Be Such a Disaster

If the Supreme Court strikes down Joe Biden’s proposed student debt cancellation plan tomorrow, the president has other, smarter options to relieve student debtors.

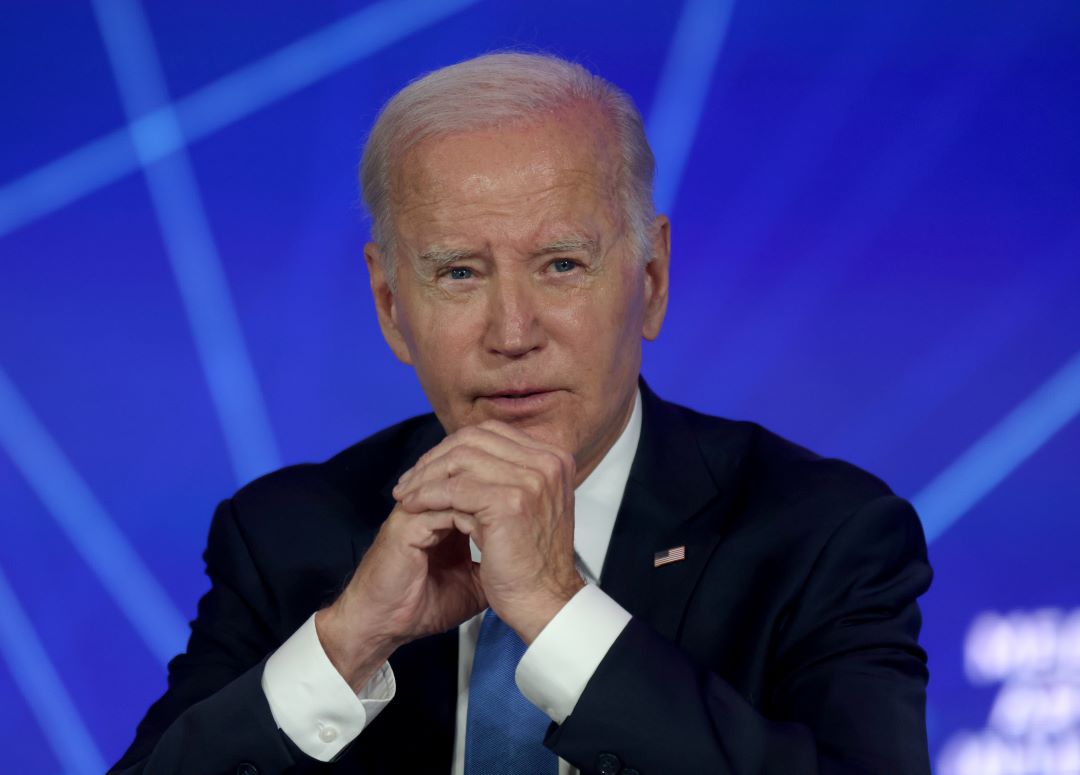

President Joe Biden meets with AI experts and researchers at the Fairmont Hotel in San Francisco, California, on June 20, 2023. (Jane Tyska / Digital First Media / East Bay Times via Getty Images)

- Interview by

- Luke Savage

This Thursday, the Supreme Court is expected to rule on the legality of Joe Biden’s student debt forgiveness program. Announced last August, Biden’s plan proposed relief of $10–20,000 for people below a certain income threshold. Soon met with a barrage of lawsuits, however, an injunction was placed on the program and its future remains uncertain.

In a recent op-ed for the New York Times, Eleni Schirmer and her colleague Louise Seamster detailed their recent investigation of the remarkably flimsy legal case being mounted against student debt relief. Schirmer, a postdoctoral fellow at the Concordia University Social Justice Centre in Montreal and an organizer for the Debt Collective, spoke to Jacobin’s Luke Savage about that investigation, the Biden administration’s handling of the student debt file, and the ways America’s legal system continues to show deference to corporate interests while hanging ordinary people out to dry.

Before we get into the specific details of the lawsuit brought against the Biden administration’s student debt forgiveness plan, lay out the basic timeline for us a bit. What exactly is at stake here, and what has brought things to the point where the Supreme Court is going to make this ruling?

The fact that Biden was the president who canceled debt is in and of itself significant. That’s the result of a decade-old movement. Biden was not at all a champion of debt abolition of any kind; he came on board in the primaries, pushing for a $10,000 cancellation when Elizabeth Warren was for $50,000 and Bernie Sanders was for canceling everything. Biden was not a champion of this policy, yet pulled the trigger on it.

That’s important context when we think about what has been achieved in this moment: the movement made Biden do something he really didn’t want to do, and his hesitation and lack of resolve on the issue showed in how he implemented the program.

On August 24, 2022, Biden announced his plan to cancel $10–20,000 of student debt for eligible borrowers who earned under $125,000 a year annually. This was after weeks of advocates and experts and leaders of all kinds of organizations — from the AFL-CIO to the NAACP — calling on Biden to cancel debt automatically with no application. People were very clear that if the policy was to stick, it needed to be implemented without an application, for the relief to be automatically delivered to people’s accounts. Biden chose not to create the program that way. So on August 24, he announced cancellation and also that people would be able to apply for it.

It took fifty-two days for the application to be available. When it came out, it was basically like a spiffy Google Form that asked for people’s names, Social Security numbers, and birthdays. That was basically it. But what was crucial about those fifty-two days was that half a dozen lawsuits from Republican-controlled states were filed against the Biden administration over the program.

Most of the suits were dismissed, but two of them stuck. In these two suits, the plaintiffs were able to find sympathetic judges in right-wing courts in Texas and Missouri. Those judges sustained the plaintiff’s challenges and imposed a national injunction on Biden’s policy.

That brings us to where we’re at now. Actually, it was in November that Biden himself requested that SCOTUS intervene on this policy, which is interesting, because the normal course of action is that when a lower court makes a ruling on something like this, it takes weeks (if not months to years) for the Supreme Court to get involved. But Biden wanted to accelerate this process, probably because of the millions of households that are waiting for the relief. Because he didn’t, I suspect, think that the case would get a fair ruling in the lower courts. All but one of the judges on the Eighth Circuit Court of Missouri are Republican-appointed judges, and it’s really saying something that the case was going to have a better shot at getting a fair hearing from this Supreme Court than from these crackpot, conservative, lower-district courts.

That brings us to where we are now. On the one hand, we’re waiting on the Supreme Court to decide on the legality of Biden’s relief plan. But on the other hand, it never should have come to the Supreme Court to begin with. Had Biden actually canceled debt and then told America afterward, “Hey guys, check your accounts. You’ll see you’ve been credited $10–20,000,” there no doubt would’ve been lawsuits, but the legal challenge of trying to reimpose a debt that’s already been canceled is more significant than one trying to stop it from happening in the first place.

And that could have been done by executive order, presumably.

Exactly right — in a bunch of different ways. What Biden ended up using to cancel the debt was a provision called the HEROES Act, which is actually a George W. Bush–era provision that gives the president the authority to cancel, waive, or modify debts because of national emergencies (like, for example, a pandemic). That was the tool that he used to cancel debt. If the Supreme Court strikes down Biden’s plan, there are several other legal pathways that Biden could choose to try to cancel debt again.

Let’s get into the lawsuit a bit. As you and your colleague Louise Seamster explained in a recent New York Times piece, the Supreme Court is actually hearing the case before any judgments on it have been made by lower courts — meaning that its core claims haven’t really gotten the kind of scrutiny they might have if they had wended their way through those lower courts.

You, however, have looked into those claims in detail. I understand much of the case has to do with the alleged injury caused to a Missouri-based loan authority. Can you unpack that for us?

This is where it gets complicated.

There are actually two cases that are in front of the Supreme Court. One was brought by two students who feel like they were either excluded from relief because they had private loans and not federal loans, or they didn’t get the maximum amount of relief because they’re only getting $10,000 instead of the $20,000 that some people are getting. That’s the basis of their suit — not that cancellation shouldn’t happen, just that they have been denied. My understanding is that legal experts generally think that is somewhat frivolous.

The one that’s considered the more serious threat is the case you’re mentioning that was brought forward by six Republican attorneys general who claim that various entities in their states will lose money from cancellation. One of the more interesting ones, though it got dismissed, was from the Nebraska attorney general, who claimed that public pensions in the state of Nebraska are invested in student loans. Should student loans be canceled, these student loan–backed assets would lose value, such that schoolteachers would have less money to retire on. Which is a really wild way to think about what student debt is: i.e., one person’s debt is another person’s ability to stop working.

Anyway, that got chucked out. But the real sticking point comes down to the State of Missouri, which basically claims that an entity in its state — the Missouri Higher Education Loan Authority (MOHELA), which is the servicer in charge of public sector loan forgiveness applications — will lose money if the debt is forgiven.

But it’s weird, because it’s not the servicer bringing the suit: it’s the State of Missouri. And it’s pretty widely acknowledged that you can’t do that. You can’t sue on behalf of somebody else. If my roommate gets laid off, for example, I can’t sue their employer for endangering their half of the rent.

But somehow Missouri has brought this suit on behalf of MOHELA. Its claim to standing is that there’s an old debt from 2008, around $105 million that MOHELA owes the State of Missouri. At no point since 2008 has the State of Missouri tried to collect on this debt, and the company in its own financial statements has basically said they don’t intend to pay that back. It’s been going on like that for the last fifteen years. Now, the State of Missouri is saying that, should MOHELA lose accounts from cancellation of student debt, revenue might become so low that they wouldn’t be able to pay back this other debt.

So, that’s where we started digging and looked at MOHELA’s revenue and found that, even in spite of cancellation, they’re set to have an absolute gangbuster year when it comes to profit and revenues — higher than at any other point in its history. And at no point did the justices in the lower courts or in the Supreme Court probe the question of whether MOHELA is actually going to lose money in a way that would threaten the State of Missouri’s finances. They simply believed the claims.

Which is, as you and Seamster pointed out in the piece, decidedly not how the state treats individual debtors.

That’s right. The irony here is that one of the reasons why MOHELA is set to have such a great year is because it became the designated servicer for a relief program for public servants. But to get access to that relief program — if, for example, you’re a schoolteacher and you had to borrow to get a master’s degree to be licensed as a teacher — you have to go back and get ten years’ worth of paperwork with signatures from your last decade of employment.

The fine-tooth comb that debtors have to employ! They’re scrutinized from all angles to make sure that they’re deserving of relief and actually credible. Meanwhile, the plaintiffs in these cases really offered little more than their word, some kind of generic financial statements about MOHELA, and a transcript from a press conference of Biden’s. And that was basically it.

If the Supreme Court does in fact throw out the debt forgiveness plan, what are the options available to the Biden administration if it’s actually serious about taking this forward? Whenever Democratic presidents don’t do things they’ve promised, there’s often a kind of deference to institutions that happens. During the Barack Obama era, for example, it was always “Well, of course they wanted to do X or Y but couldn’t because of the courts, the Senate, the Republican Party,” and so on.

The public needs to be aware that part of the reason why debt relief is vulnerable in the first place is that Biden left it wide open. By not automatically canceling debt, by making people have to apply for debt relief, he rendered it vulnerable. If Biden wants to take a second shot at cancellation, he cannot make that same mistake again. The application process has to be ditched, and he has to be ready to automatically discharge debts. Something else to remember is that, while he used this HEROES provision in the first draft of the policy, there are other provisions available.

There’s the very plain, bread-and-butter authority called the Higher Education Act, which gives the Department of Education the authority to compromise and settle its debts — which it does somewhat regularly. Cancellation of debt for the Department of Education is like a Tuesday: they just do it. So it’s just a question of them being willing to use it and of the president being willing to be bold and unwavering in his execution of relief.

What do you think accounts for the particular course that the Biden administration pursued here? One possible interpretation is that they didn’t particularly want to relieve student debt. Another might be that the program’s convoluted design, with cumbersome applications and such, simply comes down to the strange obsession some liberals have with paperwork. One can’t help but think, for example, of the Affordable Care Act and how some seemed to fetishize the program’s complexity, as if being bureaucratically complicated was somehow synonymous with good and smart design.

Where do you come down on this question?

There are some people who have taken the cynical perspective that this was Biden’s plan all along — that he wanted to set it up in this kind-of flimsy way that was going to topple over and combust. I don’t think that they’re that smart.

I think the real reason is that the Biden administration fundamentally doesn’t care about debtors. It’s just an abject lack of concern and attention to thinking about what it means to relieve people of debts and how serious that is for people. It’s a matter of being able to feed your kids or not feed your kids. We’re currently bracing at the Debt Collective for a wave of folks in mental-health crises when payments turn back on. We’re already getting notes from people who are on the edge and not sure if they can make it if payments start up again.

I think there’s just a callousness about how serious a burden this is for people and how getting it right is a difference between life and death. There’s a fundamental lack of care about how badly people need this relief — and also maybe a sort-of naive assessment of just how determined Republicans are to stop it.