No, Sky-High Drug Prices Aren’t Funding Crucial New Medical Research

Last month, the Biden administration announced it would allow Medicare to negotiate drug prices, prompting right-wing hysteria about price controls. Yet Biden's plans don’t go far enough: the state should fund R&D to further cut costs.

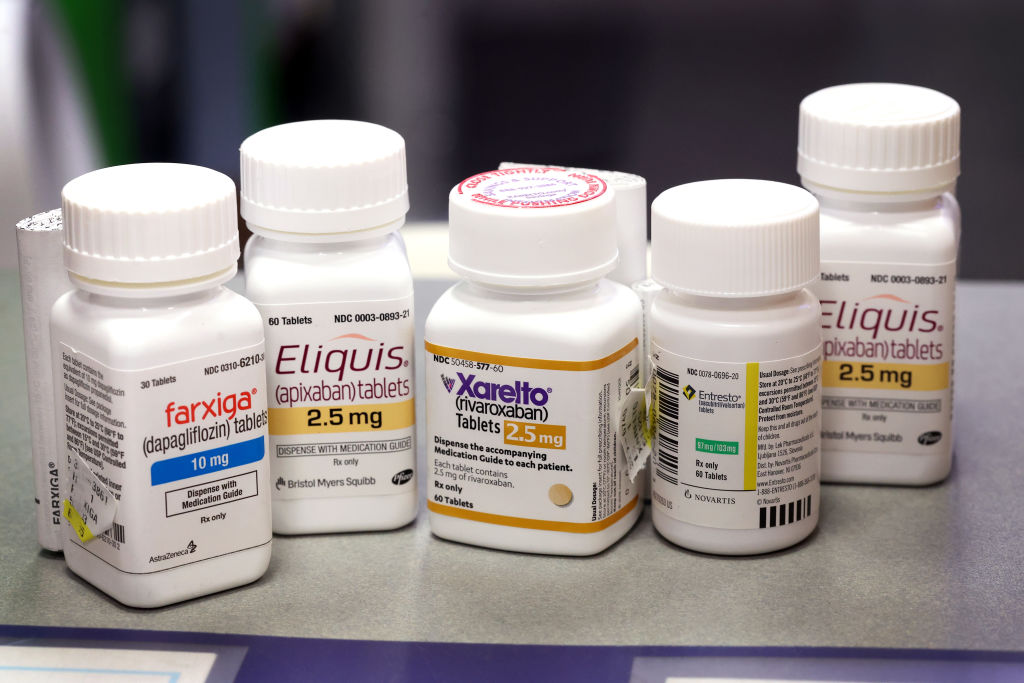

Farxiga, Xarelto, Entresto, and Eliquis — four of ten prescription drugs that will be subject to Medicare price negotiations — are made available to customers at the New City Halsted Pharmacy on August 29, 2023 in Chicago, Illinois. (Scott Olson / Getty Images)

On August 29, the Biden administration announced the list of ten drugs over whose price Medicare would, for the first time, negotiate, under new authority granted by the Inflation Reduction Act last year. According to the government, people on Medicare who took the ten drugs paid a total of $3.4 billion in out-of-pocket costs in 2022 alone, while the cost to Medicare totaled $50 billion.

The new prices will be announced by September of 2024, but will not take effect until 2026. In his announcement, Biden declared, “We’re going to keep standing up to Big Pharma and we’re not going to back down.” The new rhetoric stands in stark contrast to the Obama administration’s more indulgent stance toward the pharmaceutical industry. Fearing the industry’s formidable lobbying clout, the administration’s signature health care reform, the Affordable Care Act, left the powerful pharmaceutical industry completely unscathed. Unsurprisingly, pharmaceutical costs have become the fastest-growing component of health care costs in the ensuing years.

Big Pharma, unsurprisingly, is fighting against the Biden administration’s efforts, launching lawsuits to block the new rules. Meanwhile, writers at the Economist — also unsurprisingly — have come to the aid of Big Pharma in its hour of need. While conceding that Americans do spend too much on drugs, the “newspaper” nonetheless complains that the new “heavy handed” rules “have swung from one extreme to the other.”

What precisely, is so extreme? The Economist argues that, because the penalty for refusing to negotiate is an excise tax of up to 95 percent of a product’s sales, Medicare officials are not so much negotiating prices as setting them by fiat. Moreover, such strict price controls will ultimately harm us all, because paying high prices for patent-protected drugs is how we finance pharmaceutical innovation. Since developing new drugs is risky and expensive, drug companies will only do it if they’re promised big profits on the other end. Without those big payouts, the industry lacks the incentives to undertake research and development (R&D) and bring new treatments to market. That’s the theory at least.

Are they right?

Let’s grant for a moment the rather hyperbolic claim that the negotiation rules really are tantamount to government price controls. Is Big Pharma really a goose laying golden eggs, and would price controls kill it? The core of the argument is that by deliberately overpaying for drugs, we’re financing innovation. If that were true, we would expect to see Big Pharma aggressively reinvesting its retained profits in R&D spending.

Last year, the three largest US-listed pharmaceutical companies by revenues, Pfizer, Johnson & Johnson, and Merck, spent a combined $39.6 billion on R&D. That is, admittedly, a lot of money. But less than Medicare is currently paying on just ten drugs — a vast pool of potential savings that could simply be handed over to the National Institutes of Health (NIH) to finance R&D directly. Moreover, those same companies funneled almost as much money to Wall Street, through dividends and share buybacks, to the tune of $35.7 billion. And they also found $40.1 billion to spend — just in cash — on acquisitions of other, already-existing drug companies. That’s not even getting into the bloated marketing budgets spent on convincing both doctors and patients to buy their products. If the companies’ books are any indication, spending money on R&D for new drugs is not exactly the top priority for Big Pharma.

The truth is, the biggest pharmaceutical companies aren’t really drug development companies at all: they’re marketing, lobbying, and litigation firms with patent portfolios. While Big Pharma holds vast portfolios of existing patents for prescription drugs, the innovation pipeline for new drugs actually has very little to do with Big Pharma. In reality, public sources — especially the NIH — fund the basic research that makes scientific breakthroughs. Then small, boutique biotech and pharmaceutical firms take that publicly generated knowledge and do the final stages of research, like running clinical trials, that get the drugs to market. The share of small companies in the supply of new drugs is huge, and it’s still growing. Fully two-thirds of new drugs now come from these small companies, up from one-third twenty years ago. It is not the research labs of Pfizer that are developing new drugs.

In fact, it’s typically only at the point that a proven drug already exists that Big Pharma enters the picture. With these companies’ deep pockets derived from sales of existing drugs with patent protection, they purchase the companies that have developed the proven winners — and their patent rights. In other words, Big Pharma doesn’t invest up front to develop new drugs; it steps in at the very end, helping early, speculative investors in boutique firms to cash out. As the Financial Times recently put it, “large pharma businesses have no choice but to pursue M&A [mergers and acquisitions], because they have to fill the innovation gaps in their drug pipelines.”

Once it has bought out the innovators, Big Pharma’s real competitive strengths come into play: marketing, government relations, and litigation. It was Big Pharma’s fearsome lobbying strength, after all, that kept Obamacare away from the industry’s profits. And on the litigation side, Big Pharma has had great success using the courts to engage in tactics like “pay for delay,” where companies sue generic manufacturers for patent infringement, and then pay them off to keep the drugs off the market longer in the eventual settlement. Big Pharma also excels at gaming patent and other regulatory exclusivities in other ways — by means such as evergreening old drugs (for example, changing a drug from a capsule to a tablet) and indiscriminate patenting, the latter often slow-walked over time to maximize the length of patent protection.

At this point, we can make out the outlines of the Rube Goldberg machine by which overpaying for drugs supposedly leads to medical innovation. We massively overpay Big Pharma for patent-protected drugs, on purpose. While a big chunk of those monopoly profits are siphoned off to Wall Street, some of it trickles down to help Big Pharma buy out smaller, innovative drug companies — with Wall Street banks and law firms of course taking a cut in this acquisition process. Finally, the argument goes, the small innovators depend on the expectation of just such buyouts to motivate themselves to undertake difficult and costly clinical trials. Ergo, if Medicare squeezes Big Pharma’s profits, all incentives to innovate will be lost.

Now, it is true that developing new drugs is risky and costly. It definitely does require public subsidies of some kind, which the United States provides on both the supply side (NIH research) and the demand side (patent protection, all the prices Medicare doesn’t negotiate). If we didn’t subsidize pharma through overpaying for drugs, we would have to finance innovation in some other way.

Are there alternative models for financing innovation? Economist Dean Baker has long pointed out one obvious alternative: instead of the Rube Goldberg monopoly machine that we have now, we could just pay for R&D ourselves from basic research through to commercialization — directly. As Baker points out, drug companies are the biggest proponents of public funding for NIH pharmaceutical research, which they rely on and value heavily. But they also insist on privatization of the clinical trials stage — seemingly arguing that those same brilliant NIH researchers suddenly turn into incompetent hacks at that point.

Moreover, even if we believed the private sector was more effective at innovation, overpaying for drugs is far from the most obvious way to harness the private sector for public good. Instead of patent monopolies and Medicare subsidies, the government could simply contract with the same small firms that Big Pharma currently targets for buyouts, and cut out the middleman — paying them to develop drugs. The military-industrial complex has hardly been hampered in its ability to develop life-destroying innovations through a similar procurement process; why would lifesaving innovations be any different?

Finally, there are plenty of reasons to believe that market incentives driving drug development may do more harm than good in health care industries, because market prices drastically underprice social benefits. For example, the current incentives for pharmaceutical firms are to create drugs that treat chronic conditions, even relatively unserious conditions like erectile dysfunction, rather than cure life-threatening diseases, which, after all, only need curing once. During a recent severe Ebola outbreak, public attention was briefly focused on the failure of the pharmaceutical industry to develop effective vaccines or treatments for the disease. The World Health Organization director-general at the time, Margaret Chan, lambasted the pharmaceutical industry, blaming the for-profit nature of the industry for its failure to invest in treatments for life-threatening illnesses. “The R&D incentive is virtually nonexistent,” she said. “A profit-driven industry does not invest in products for markets that cannot pay.”

We currently pay for innovation in medicine by throwing huge sums of money at giant corporate monopolies, and then hoping enough trickles down to the biotech researchers actually doing the innovation to incentivize continued R&D. If we were designing an innovative ecosystem from scratch, we would be highly unlikely to create one like that. In fact, when we needed a vaccine, and fast, to fight the COVID-19 outbreak, we used an entirely different model, based on direct financing. We have viable alternatives to the Rube Goldberg monopoly machine. In that light, the big risk from the Biden administration’s new rules is that they turn out to take too long to go into effect, or don’t go far enough.

The current system is obviously a great one for perpetrating the power of Big Pharma: using monopoly rents from existing patent portfolios, companies can keep buying the patents that will provide the next generation of monopoly rents. However, it’s much less clear that the system is actually the best way to finance innovation in lifesaving medications.