Rashida Tlaib’s Plan to Combat Poverty

Last week, Congresswoman Rashida Tlaib proposed three pieces of legislation under the umbrella of her “Economic Dignity for All Agenda.” These bills would create a comprehensive system of economic security reaching nearly every American.

The combined impact of the bills contained in Rashida Tlaib’s proposed “Economic Dignity for All Agenda” could dramatically reduce poverty and inequality. The only question is whether Congress has the political will to enact them. (Anna Moneymaker / Getty Images)

On Friday, November 21, Representative Rashida Tlaib introduced a comprehensive “Economic Dignity for All Agenda” (EDAA) consisting of three bold legislative proposals: updated versions of the End Child Poverty Act and the BOOST Act, alongside the new Baby Bonus Act. Together, these bills represent one of the most ambitious attempts to restructure America’s social safety net. While each component targets a specific demographic, the agenda as a whole establishes a universal system of economic security from infancy through retirement age.

Using PolicyEngine’s microsimulation model, I calculated the overall impact of the agenda. The results are nothing short of remarkable.

The Three Bills

Before diving into the numbers, it’s worth understanding what each component does.

Families welcoming a child into the world experience a significant decline in earnings during the months before and after birth. Compounded by the fact that the United States remains the only developed-world country without guaranteed parental leave, families routinely experience economic insecurity during what should be a special time in their lives. The Baby Bonus Act would provide a one-time $2,000 payment to families with a newborn. The bonus is able to be claimed at birth or two months before the child’s expected due date. This simple, yet flexible payment allows families to offset the cost of pregnancy, supplement a few weeks of unpaid leave, or purchase everything necessary to care for their newborn. The Baby Bonus payment is adjusted for inflation and can be claimed by adoptive parents, including those utilizing surrogacy.

The United States currently provides two tax credits, the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC), to families with children. Both have a phase-in structure, excluding low-income families and have administrative issues leading to over- and underpayments. The End Child Poverty Act (ECPA) consolidates the tax credit mess into a universal child allowance. Building on the 2023 version previously analysed, the 2025 iteration provides a universal benefit for every child under nineteen equal to the difference between the one- and two-person federal poverty line, equal to $469 per month ($5,630 annually) in 2026. Additionally, tax filers receive a credit of $700 for single filers or $1,400 for joint filers (ages 19–64), phasing out at a 5 percent rate above $20,000 for single filers and $40,000 for joint filers. Adult dependents nineteen or older receive an additional $700 credit (no phaseout). The filer and adult dependent credits are indexed for inflation. The most significant change in the 2025 ECPA is that state-level EITCs and CTCs are retained when previously they would have been eliminated. Upon passage, states can decide for themselves if they would like to keep their state credits or alter them (hopefully in a more universal direction).

Finally, the BOOST Act provides a $250 a month universal basic income to support working-age adults (19–67). The previous version of the BOOST Act was designed as a tax credit with a phase-out structure. The 2025 BOOST Act truly embraces a universal approach as its phaseout is replaced with a 2.5 percent tax on AGI above $30,000 for single filers and $60,000 for joint filers. These thresholds are also inflation-adjusted.

The Social Security Administration (SSA) would administer each program through newly established offices designed to eliminate the administrative barriers that leave billions in benefits unclaimed each year. By streamlining applications and enabling automatic enrollment where possible, the offices would ensure benefits reach those entitled to them.

With this agenda, all age groups across the country would receive a universal benefit from the federal government: when we are born, when we are children, when we are working-age, and when we retire. While each bill could stand on its own, the impact of this agenda being enacted would be truly transformational.

The Agenda’s Impact

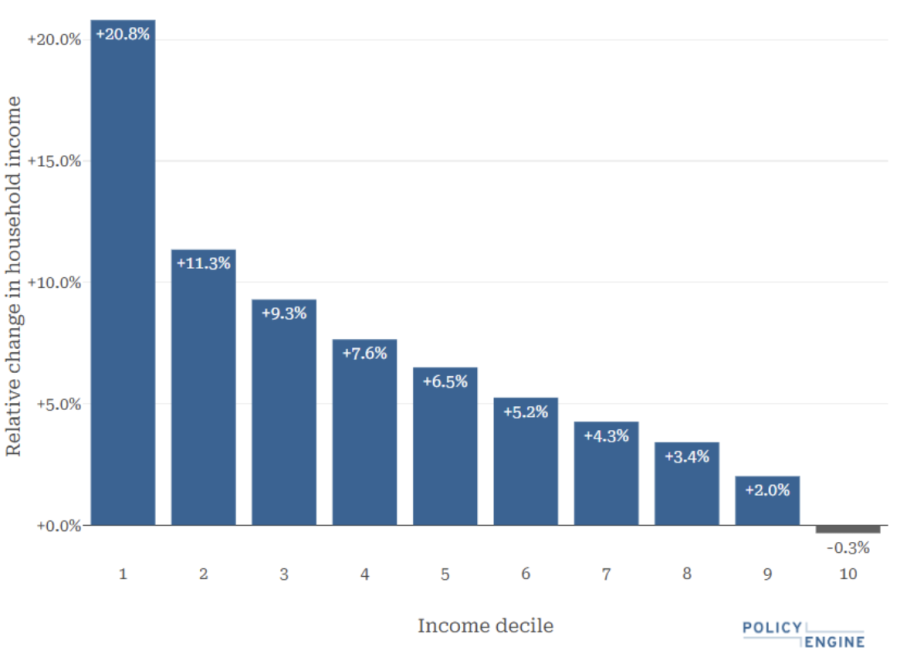

Families with no income would see substantial income gains. Under current law, a single parent with a newborn and no earnings receives nothing from the EITC or CTC due to their phase-in structures. Under the EDAA, that same family would receive $11,330 annually ($2,000 Baby Bonus, $5,630 child benefit, $700 filer credit, and $3,000 BOOST payment) — enough to escape deep poverty and establish basic economic security during their child’s crucial first year. Households in the bottom decile would experience an average gain of 21% to their net income as a result of the EDAA. Every decile would see a boost to their net income, except for the highest, as their average tax burden would exceed the benefits they receive.

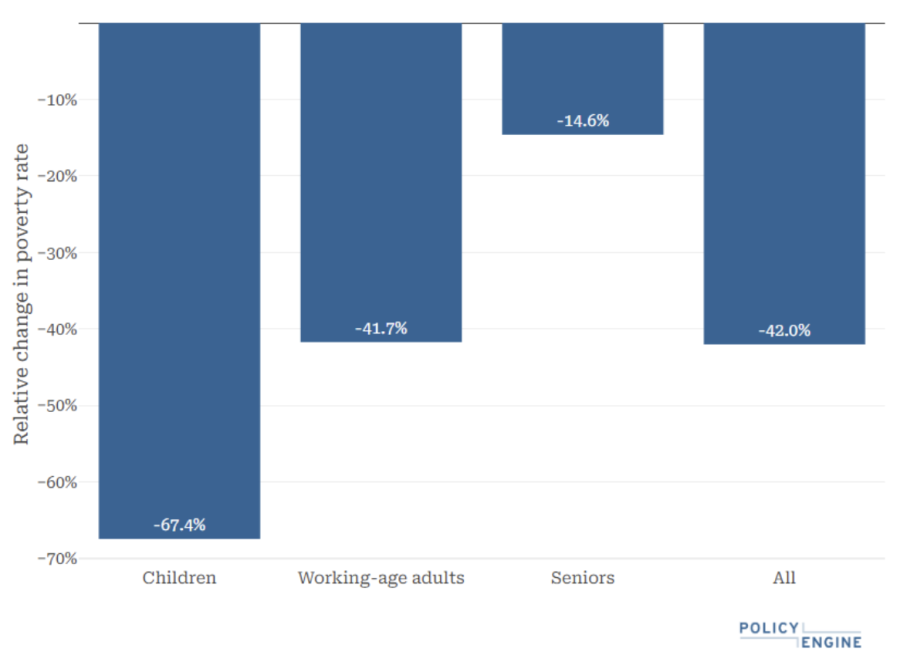

Overall poverty, as measured by the Supplemental Poverty Measure, would fall by 42 percent, while deep poverty (which includes households below 50 percent of the poverty line) would decline by 47 percent. This would put the US poverty rate at unprecedented levels, likely never seen before. Furthermore, child poverty would fall by two-thirds, and deep child poverty would nearly disappear, falling by 83 percent. For context, the expanded CTC in 2021 (and other social safety net expansions) reduced the child poverty rate by 46 percent. The EDAA would lift millions of Americans above the poverty line, expanding economic security on a scale not seen since the New Deal and Great Society eras.

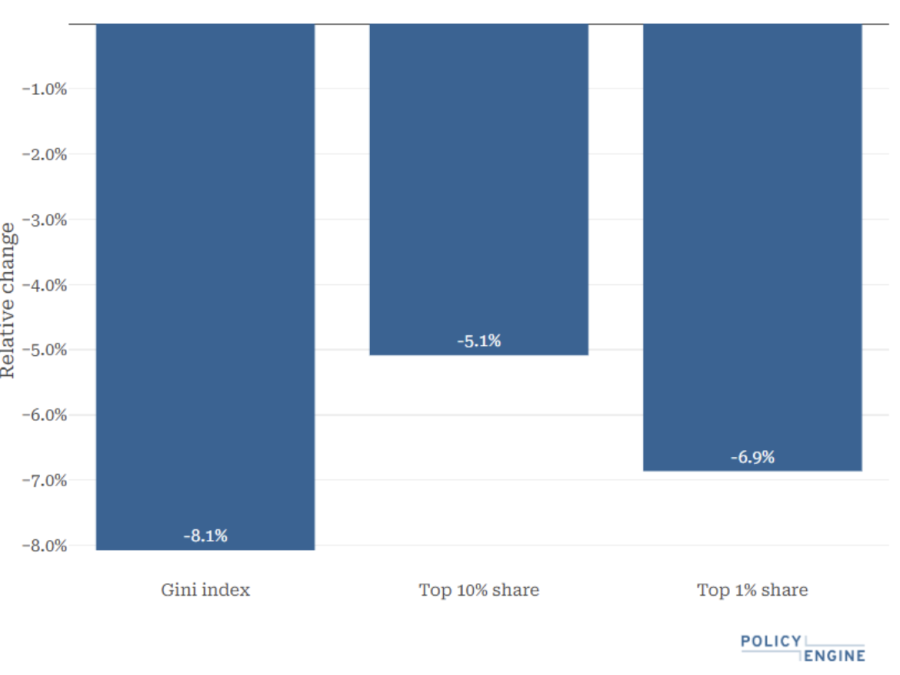

Finally, the EDAA would reduce the Gini index by 8.1 percent, lowering income inequality in the United States to its lowest level since the 1980s and ’90s. Additionally, the share of net income held by households in the top 10 percent and 1 percent would also decline. If the agenda were paid for using progressive policies, both the Gini index and the share of income held by the wealthiest households would fall even further.

Conclusion

Representative Tlaib’s Economic Dignity for All Agenda isn’t just incrementally better than the current system; it’s transformative. By supporting new parents through the Baby Bonus Act, establishing a universal child allowance through the End Child Poverty Act, and extending direct assistance to working-age adults through the BOOST Act, the agenda creates a comprehensive system of economic security that reaches nearly every American.

The numbers speak for themselves. Child poverty would fall to historic lows, overall poverty would decline by more than two-fifths, and income inequality would reach levels not seen in decades. The agenda would cost $685 billion in 2026, requiring significant funding, but the return on investment, in reduced poverty, improved child outcomes, and economic security, is undeniable.

The enhanced CTC of 2021 was good. It showed what was possible when we decided to fight poverty seriously. But it was temporary, and it’s long gone. The EDAA is better. It’s universal, it’s permanent, and it transforms poverty reduction from an aspiration into a reality.

The question now is whether Congress has the political will to enact it. The policy case is clear. What remains is the choice: Will we continue to tolerate persistent poverty that deprives families of realizing the American Dream, or will we finally build the economic system we deserve? I urge progressives in Congress to rally behind Representative Tlaib’s Economic Dignity for All Agenda. This is the agenda we’ve been waiting for.